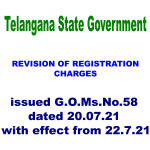

The Telangana government is all set to revise land rates for Telangana Property Registration. This registrations charges effect from 22 July 2021.

by…RERA Licensed Real Estate Agent in Hyderabad

Revised Telangana Registration Charges w.e.f 22-07-2021

- After the formation of the new state of Telangana, owing to significant growth in IT, Pharma, Tourism, Infrastructure projects, formation of new districts, and growth in other sectors, there has been a substantial appreciation of land values. New Irrigation projects have come up and vast areas of ayacut have been developed leading to considerable increase of land values.

- The ‘Guidelines Market Value’ also known as ‘Basic Value’ for registration was last revised in 2013. In the nascent years of the state, in order to stabilise and augment growth in various sectors, the guidelines values were not revised.

- Now, an elaborate and detailed exercise has been carried out for revision of the basic value. The exercise has been done in accordance with Telangana

- The Government has issued G.O.Ms.No.58 dated 20.07.21 to implement the revised basic values with effect from 22.7.21 for Telangana Property Registration.

- The lowest value for agricultural lands has been fixed at Rs.75,000/- per acre. For agricultural lands, the existing values have been enhanced by 50% in lower range, 40% in mid range and 30% in higher range.

- Likewise, in case of open plots, the lowest value hitherto was Rs.100/- per sq.yard which has now been revised to Rs.200/- per sq.yard. The basic values for open plots have been revised by 50% in lower range, 40% in mid range and 30% in higher range.

- The existing lowest value for flats/apartment was Rs.800/- per sq.ft which has now been revised to Rs.1000/- per sq.ft. In case of flats/apartments, the increase is by 20% in lower ranges and 30% in higher ranges.8. The Stamp duty rates in the State are amongst the lowest in the country. In the neighbouring states, the duty rates are much higher – TN (11%), Kerala (10%), AP (7.5%). The Cabinet Sub Committee, after detailed deliberations, recommended enhancement of stamp duty rates. After careful consideration of the matter, Stamp duty rates have been revised to 7.5 % from 6 % for sale and other transactions.

- The revised Market Values and Stamp duty rates will be implemented from 22-07-2021.

- All registrations which will take place on or after 22-07-2021 will be as per new rates, even if slots have been booked and payments have been made earlier.

- In cases where payments have already been made for registrations and slots have been booked for 22-07-2021 and thereafter, a module titled “Additional payments for Slots already booked” is made available in Dharani for making additional payments. The differential amounts can be paid and transactions carried out on the slotted day.